Retirement Age Realities: Social Security, Shifting Demographics, and Risky Moves

Generated Title: Social Security's "Perfect" Retirement Age of 63? The Data Just Doesn't Add Up

The Myth of 63: A Data-Driven Reality Check

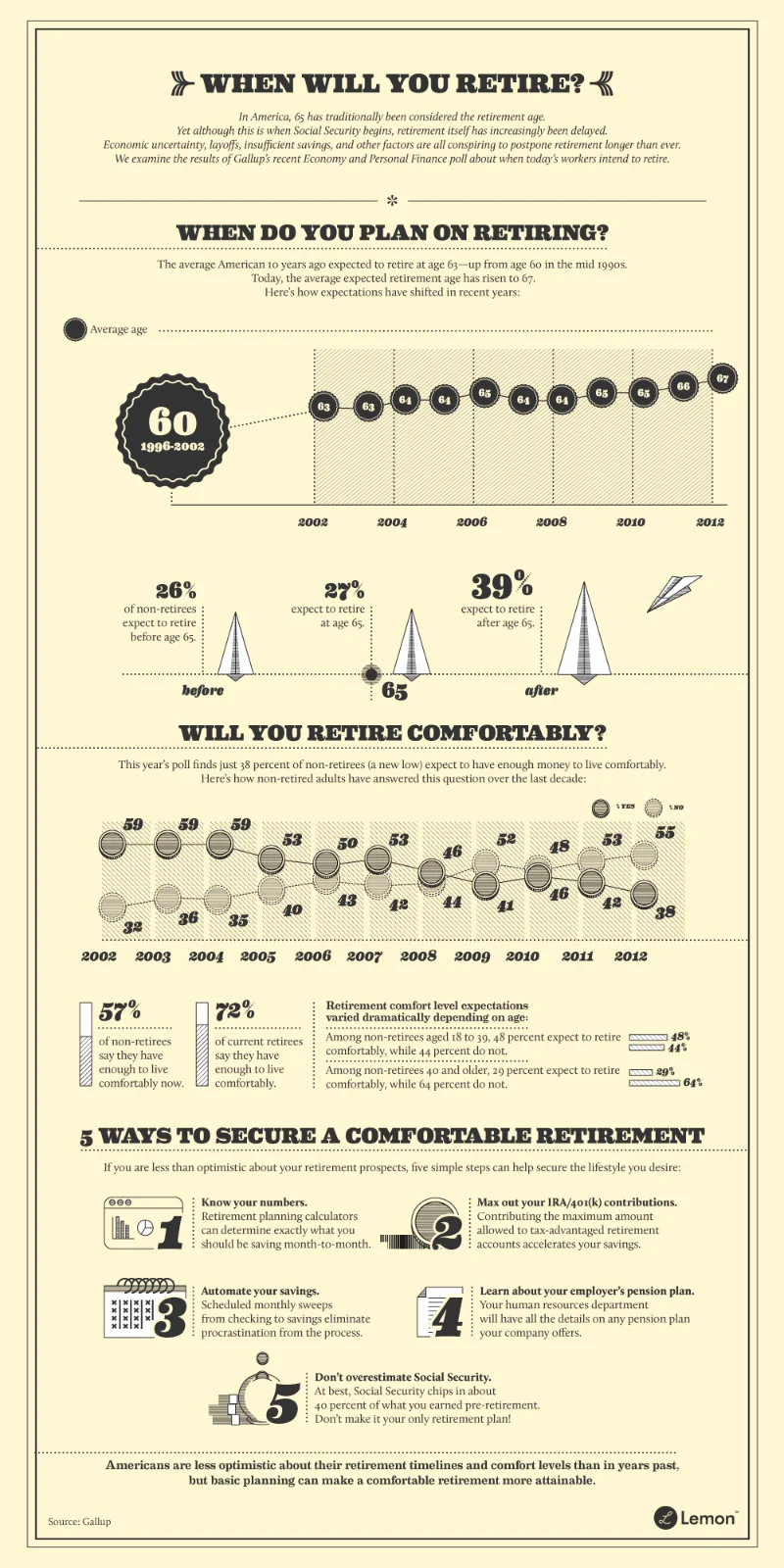

The narrative that 63 is the "perfect" retirement age persists, fueled by surveys and wishful thinking. A recent MassMutual Retirement Happiness Study even pinpointed 63 as the ideal age to leave the workforce. But let’s inject some data into this emotionally charged discussion. The problem isn't the feeling of 63, it's the cold, hard reality of Social Security, Medicare, and longevity.

The core issue? Full Retirement Age (FRA) for Social Security is 67 for anyone born in 1960 or later. Claiming benefits at 62, the earliest possible age, results in a permanent reduction of roughly 30%. Retiring at 63 puts you in a financial no-man's land: smaller Social Security checks forever, more years drawing on savings, and fewer years contributing to retirement accounts.

The latest Social Security Administration (SSA) data confirms a 2.8% cost-of-living adjustment (COLA) for 2026, increasing the average retirement benefit by about $56 per month. Sounds good, right? But that increase hardly compensates for the structural challenges facing Social Security. The program is projected to face insolvency within the next decade. If Congress fails to act, we're looking at potential across-the-board benefit cuts of around 24%. Claiming early at 63, therefore, becomes a gamble on a reduced amount that could be further slashed. 3 important Social Security changes coming in 2026.

Shifting Sands: 401(k) Limits and the Looming Social Security Crisis

The IRS is offering a lifeline, of sorts. Contribution limits for 401(k)s and IRAs are increasing for 2026. Workers aged 50 and over can now contribute up to $32,500 a year to their 401(k)s, and some older workers can contribute even more—up to $35,750. The message is clear: if you're in your late 50s or early 60s and still working, the system is incentivizing you to play catch-up. But this only benefits those who can still work and save, not those already retired at 63.

I've looked at enough retirement plans to know that the average American isn't maxing out their 401(k). (The median retirement savings for those aged 55-64 is nowhere near enough to retire comfortably at 63.) We're also seeing innovations like Bank of America's "401k Pay," designed to convert 401(k) balances into predictable income streams. This highlights a crucial shift: the focus is now on generating sustainable income, a challenge that's particularly acute for those retiring in their early 60s.

A report from the Committee for a Responsible Federal Budget warns against using general federal revenue to bail out Social Security. They suggest targeted solutions like adjusting benefits, raising payroll taxes, or increasing the retirement age. All of these options could negatively impact future retirees, especially those planning to retire in their early 60s.

It’s also crucial to check your Social Security earnings record before the end of 2025. Your benefit is based on your 35 highest earning years, so any missing or incorrect information can permanently reduce your monthly check.

The "Perfect" Salary Mirage

People want to retire at 63, and they think they know what income they need to feel content. A recent survey suggests the "perfect salary" is around $74,000 per year. About 1 in 5 believe they need at least six figures to feel truly comfortable. But the median weekly earnings for full-time workers in the U.S. is closer to $62,200 a year. This gap between aspiration and reality explains why many households can't save enough to retire at 63, and why pre-retirees report being behind on their retirement savings.

So, what's the right retirement age? There isn't a single answer. 63 should be viewed as a checkpoint, not a finish line. It's a time to stress-test your retirement budget, finalize your Social Security claiming strategy, and consider whether part-time or phased retirement could bridge the gap.

Instead of fixating on 63, focus on the numbers that truly matter: your replacement rate (how much of your working income your retirement income will replace), your longevity horizon (plan as if you or your spouse will live into your late 80s or 90s), and your contribution rate (especially now that 2026 limits allow many workers in their 50s and early 60s to save aggressively).

It's a Financial Cliff, Not a Sweet Spot

The data paints a clear picture: retiring at 63 might feel right, but financially, it's often a precarious move. The confluence of reduced Social Security benefits, rising healthcare costs, and potential future benefit cuts creates a perfect storm of financial risk.

Related Articles

Retirement Age BS: What's the "Full" Deal and Why Should I Care?

Alright, let's get this straight. Social Security changes in 2026? They're trying to spin this as so...