Retirement Age BS: What's the "Full" Deal and Why Should I Care?

Alright, let's get this straight. Social Security changes in 2026? They're trying to spin this as some kind of win? Give me a break. We're talking about the government here, and "good news" and "government" are about as compatible as oil and water.

COLA: A Pathetic Attempt at a Band-Aid

So, the cost-of-living adjustment (COLA) is going up 2.8%. Woo-freaking-hoo. They announce this like they're handing out free money, but let's be real: it's just barely keeping pace with inflation. And according to Shannon Benton from The Senior Citizens League, it's still gonna "hurt for seniors". Ya think?

It's like getting a $20 gift card to a fancy restaurant when you're starving and the cheapest thing on the menu is $50. Thanks, but I'm still hungry.

And then there's the Medicare Part B premium increase looming. Expected to jump 11.6%? So much for that COLA boost. It's the government giving with one hand and then immediately reaching for your wallet with the other.

What's the point of a COLA if it gets eaten up by other rising costs? Are they deliberately trying to gaslight us into thinking we're better off than we actually are?

Earnings Limits: A Trap for the Working Class

Oh, and the earnings limits for early retirees are going up too. Great, so you can earn a little more before they start clawing back your benefits. It's still a punishment for people who need to work. It's not like these folks are choosing to work for kicks. They're doing it because Social Security ain't enough to live on.

The Social Security Administration (SSA) will deduct $1 from benefit payments for every $2 earned above an annual limit for anyone who is under their full retirement age for the entire year. In 2025, that annual limit was $23,400 ($1,950 per month). However, it's increasing to $24,800 ($2,040 per month) in 2026.

So they're increasing it...by a measly amount. Whoop-dee-doo.

Let's be real, this whole system is designed to screw over the working class. You pay in your whole life, and then they make it as difficult as possible to actually collect what you're owed.

The FRA Freeze: A Temporary Reprieve

Okay, here's the one thing that might be considered "good news," and even that's a stretch. 2026 is supposedly the last year the full retirement age (FRA) gets pushed back. For anyone born in 1960 or later, the FRA is supposed to stay at 67. This Social Security Change Will Happen for the Last Time in 2026

Supposedly.

Like I trust anything these clowns promise.

Before that:

Those born in 1957 had to wait until 66 and 6 months.

Those born in 1956 had to wait until 66 and 4 months.

Those born in 1955 had to wait until 66 and 2 months.

Those born between 1943 and 1954 had to wait until age 66.

Only people born before 1943 got to claim at the previously standard age of 65. So, for many years, every new group that aged into the system has had a slightly longer delay before they could start their Social Security checks. This has meant either waiting longer to start benefits, accepting a reduced benefit, or relying on distributions from retirement plans to provide income while waiting for Social Security to begin.

The fact that the FRA will remain stable—as long as lawmakers don't make changes—will make retirement planning easier, as all future retirees will know that 67 is the milestone they must reach to receive their standard benefit.

It's like they're patting themselves on the back for not making things worse. "Hey, we're not actively trying to ruin your retirement! Aren't we great?"

Honestly, it's insulting.

And who knows what these clowns in Washington will do next? They could change the rules tomorrow. This whole thing is built on a foundation of sand.

Maximum Taxable Earnings: More for the Rich

And ofcourse, let's not forget the increased maximum taxable earnings. The amount of income subject to Social Security taxes is going up to $184,500 in 2026. 3 important Social Security changes coming in 2026 This mostly affects higher-income earners, meaning they'll be paying more into the system.

The maximum amount of earnings subject to the Social Security portion of FICA payroll taxes will increase to $184,500 in 2026 from $176,100 this year. All employees must pay 7.65% of their salaries to help fund both Social Security and Medicare. Employers pay the same rate for each employee. Self-employed individuals pay both the employee and employer FICA taxes, for a total of 15.3%.

Income above $184,500 won't be subject to FICA taxes in 2026. However, it's likely the maximum taxable earnings threshold will increase again in future years.

But let's be honest, it's just another way for the government to squeeze more money out of us. And I bet you that number will creep up and up in the coming years. They'll say it's for the "greater good," but we all know where that money's really going...

Prepare for Disappointment

So, Social Security changes in 2026? The last "good" news? Maybe. But I ain't holding my breath.

Related Articles

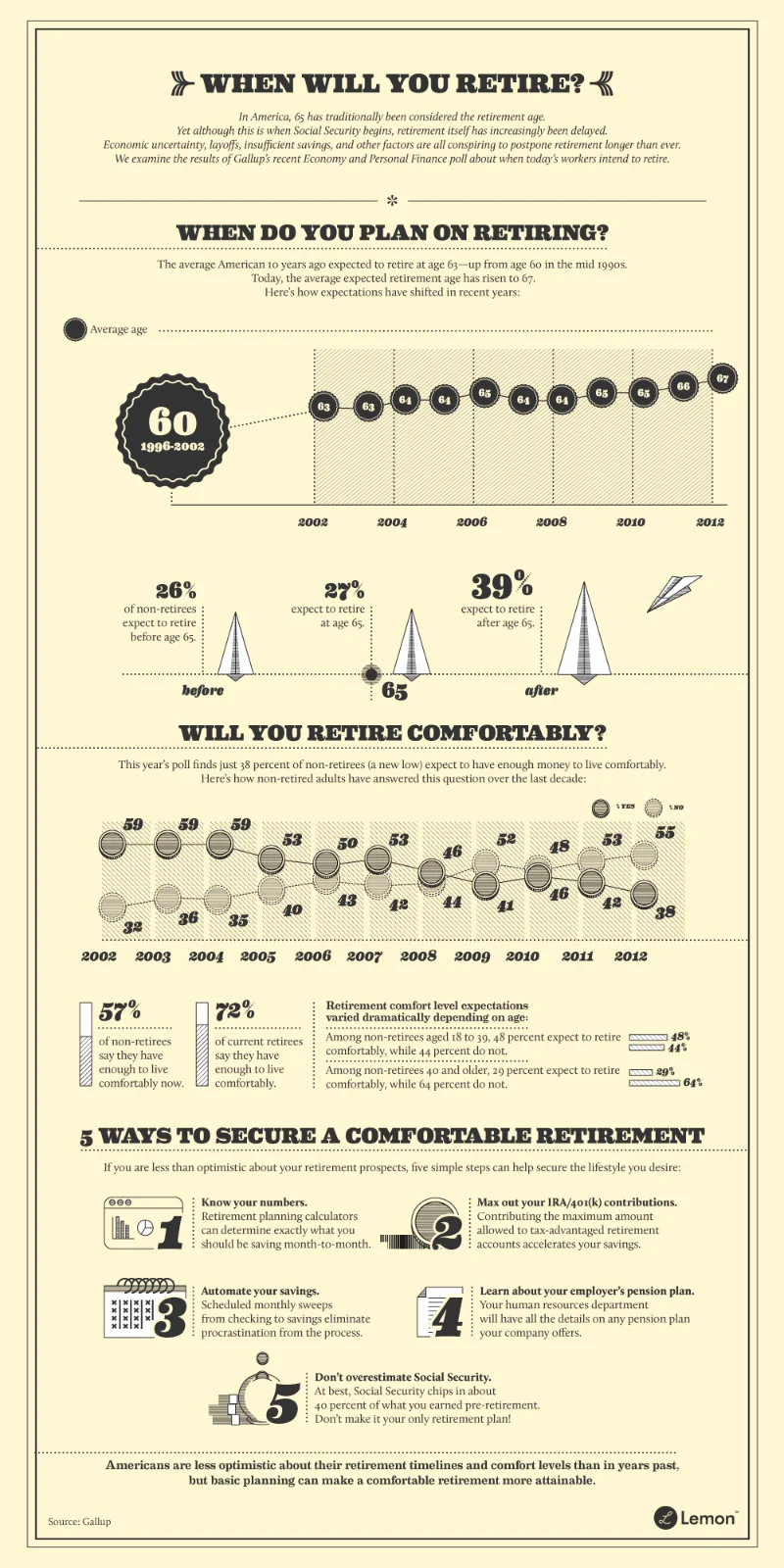

Retirement Age Realities: Social Security, Shifting Demographics, and Risky Moves

Generated Title: Social Security's "Perfect" Retirement Age of 63? The Data Just Doesn't Add Up The...