Netflix Stock Split: What's the Real Impact?

Julian Vance: Netflix's Stock Split - A Clever Illusion?

Netflix's recent 10-for-1 stock split has been generating a lot of buzz, and the headlines are predictably optimistic. The idea is simple: lower the per-share price to make it more accessible to retail investors. Makes sense, right? But let's dig into the numbers, because the surface story doesn’t always tell the whole truth.

The Split: What Changed (and What Didn't)

On November 17, 2025, Netflix officially began trading on a split-adjusted basis. Pre-split, the stock was hovering around $1,112. Post-split? Roughly $111-$112. As expected. The financial news sites are all chirping about how this makes Netflix more appealing to the average Joe. And, sure, psychologically, a three-digit price tag looks more inviting than a four-digit one. But let's be clear: a stock split is purely cosmetic. It's like cutting a pizza into more slices – you still have the same amount of pizza.

The total market capitalization of Netflix remains unchanged. If you owned one share at $1,112, you now own ten shares at $111.20 each. The value of your position is the same. The company’s fundamentals are the same. Nothing fundamentally changed (pun intended) from a balance sheet perspective.

So, why do it? Netflix claims the split is intended to make the stock more accessible to employees, particularly those participating in stock option programs. That's a decent PR spin. A lower price could encourage more employee participation, but let’s be honest, the real motivation is likely increased trading volume and liquidity. A lower price invites more retail investors, which can drive up demand, and therefore the price.

The Numbers Behind the Hype

Several reports highlight Netflix's strong Q3 2025 performance. Revenue grew 17.2% year-over-year, and analysts are pointing to the ad-supported tier as a major growth driver. Advertising revenue supposedly doubled in 2024 and is on track to double again in 2025. But let's put that in perspective. While doubling sounds impressive, we need to know the base number. If ad revenue was a negligible fraction of total revenue to begin with, doubling it doesn't necessarily translate to a significant impact on the bottom line. Details on the actual ad revenue numbers are surprisingly scarce; color me suspicious.

Operating margins are expected to rise from 27% in 2024 to around 29% in 2025. This is good news, but it's worth noting that Q3 2025 margins took a hit due to a $600+ million tax expense in Brazil. The company frames this as a one-off event, but regulatory surprises are always a risk, especially for a global company like Netflix.

And this is the part of the report that I find genuinely puzzling. Multiple sources cite a "Moderate Buy" consensus from analysts, with an average 12-month price target of around $139.86 post-split (or $1,398.59 pre-split). This implies a roughly 25% upside from current levels. But here's the discrepancy: these same analysts acknowledge that Netflix is already trading at a premium, with a forward P/E ratio in the mid-30s. So, they're saying the stock is expensive, but also recommending it as a buy with significant upside? That doesn't quite add up. What assumptions are they making about future growth to justify that valuation?

It's like saying a house already costs twice as much as it should, but you recommend buying it because you think the neighborhood will gentrify. Maybe. But there's a lot of risk baked into that assumption.

The Risks Remain

Despite the positive spin, the risks facing Netflix haven't magically disappeared with the stock split. Competition in the streaming space is fierce, with deep-pocketed rivals like Disney+ and Amazon Prime Video vying for market share. Netflix needs to continue investing in content and innovation to stay ahead, which could put pressure on margins. Amazon seeks $12B in bond sale, Netflix trades after stock split

There's also the question of strategic direction. Some reports suggest Netflix may be considering acquisitions, potentially even parts of Warner Bros. Discovery. That would be a major shift for a company that has historically focused on organic growth. Acquisitions can be risky and expensive, and there's no guarantee they'll pay off.

Smoke and Mirrors?

The Netflix stock split is a classic example of financial engineering. It creates the illusion of accessibility without changing the underlying fundamentals of the business. While it might attract some new retail investors and boost trading volume, it doesn't address the core challenges facing the company: intense competition, valuation concerns, and strategic uncertainty. Smart investors should look beyond the headlines and focus on the numbers.

All Hype, No Substance

The stock split is a magician's trick, designed to distract from the real questions about Netflix's long-term value.

Related Articles

P.F. Chang's Gets Another CEO: What Happened and Why?

P.F. Chang's CEO Revolving Door: Is Anyone Actually in Charge? Alright, let's get this straight. P.F...

American Battery's Breakthrough: Why It's Surging and What It Means for the Future of Energy

The Quiet Roar of the Energy Transition Just Became Deafening When I saw the news flash across my sc...

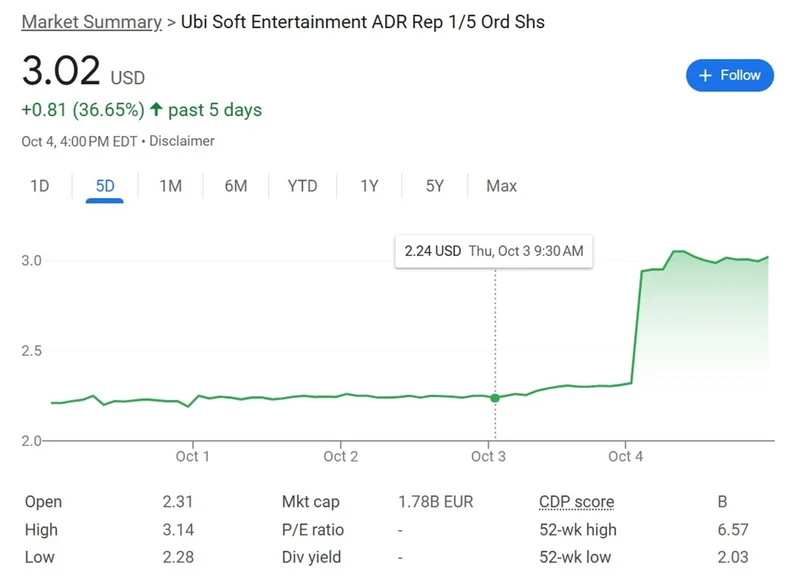

Ubisoft Stock Halt: What's Going On and Why Reddit's Freaking Out

Ubisoft's Stock Halt: Is This the End, or Just Another Level of Corporate Bullshit? Alright, let's g...

US Approves Nvidia Sales to UAE: An Analysis of the G42 Deal and Its Geopolitical Implications

It’s a familiar ritual for anyone in this business. The pre-market hum, the first cup of coffee, and...

US Government Backs Trilogy Metals (TMQ): Why It's Soaring and What It Signals for America's Future

I just read a press release that, on the surface, is about a mining company in Alaska. And I can’t s...

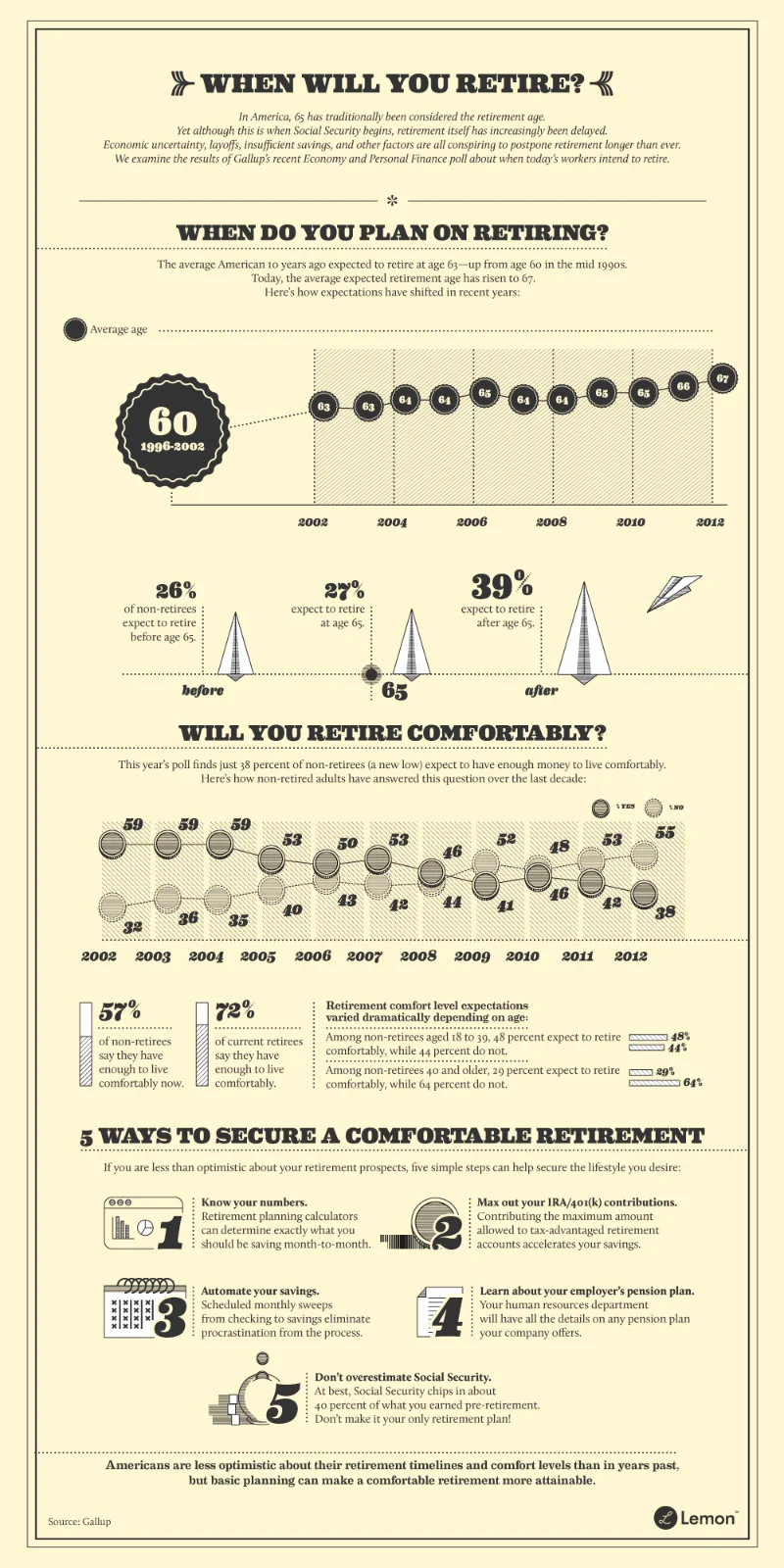

Retirement Age Realities: Social Security, Shifting Demographics, and Risky Moves

Generated Title: Social Security's "Perfect" Retirement Age of 63? The Data Just Doesn't Add Up The...