The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again.

Let me guess. You saw the headlines in September. "The Fed Cuts Rates!" And you, like a perfectly conditioned consumer, felt a little flutter of hope. You pictured your bank calling you, begging you to take out a 30-year fixed-rate mortgage at a number that didn’t make you want to cry. You imagined the floodgates of cheap money opening, washing away the sins of 7%-plus rates.

Give me a break.

That whole song and dance is one of the biggest, most convenient lies we're told about the economy. Believing the Federal Reserve chairman directly sets your mortgage rate is like believing the weatherman controls the weather. He stands up there at his little podium, points at some charts, and makes a grand pronouncement about the economic forecast. But he isn't the storm. He's just the guy on TV telling you to grab an umbrella, often after you're already soaked.

The "storm," the real force that actually dictates whether you’ll be paying 6.5% or 7.5% on your house, is the bond market. And it couldn’t care less about the Fed's press conference. Look at the facts. The Fed cut its rate in September, and what happened? The average 30-year mortgage rate is now 6.49%, which is actually up from the 6.13% low we saw right before the cut. How does that fit the neat little narrative? It doesn't. Because the narrative is a fairy tale.

Meet the Real Boss: The Bond Market

If you want to know who’s really pulling the levers on your mortgage, stop looking at the Fed and start looking at something far more boring and infinitely more powerful: the 10-year Treasury yield.

This isn’t some conspiracy theory I cooked up. It’s just… how it works. In fact, it's a constant debate among financial experts: Which impacts mortgage interest rates more: the Fed or the 10-year Treasury yield? Experts weigh in - CBS News. I talked to a few people who actually live in this world, not just report on it from a distance. JD Pisula, a CEO at some advisory firm, put it bluntly: the "typical average life of a mortgage is somewhere between five and nine years." So, offcourse, the rates are tied to Treasury notes with similar lifespans, like the 7-year and 10-year.

Think of it like this: your mortgage isn't just a simple loan between you and a bank. It’s a product. That loan gets chopped up, bundled with a thousand others, and sold as a mortgage-backed security (MBS) to giant investors. These investors have options. They can buy your mortgage bundle, or they can buy a super-safe, government-backed 10-year Treasury bond. For them to bother with the slightly riskier mortgage stuff, the return has to be better. So, as a rule of thumb, mortgage rates hover about 1.5% to 2.0% above whatever the 10-year Treasury is yielding that day.

Jamie Slavin, a manager at Ent Credit Union, said it moves in "near real time." A lender can literally change the rate on a loan in the middle of the day if the Treasury yield has a seizure. The Fed, meanwhile, meets eight times a year. It's a bad idea. No, 'bad' doesn't cover it—this is a fundamental misunderstanding of the entire system. The Fed is playing checkers while the bond market is playing 4D chess across multiple timelines.

So why does everyone, from cable news anchors to your uncle at Thanksgiving, get this so wrong? Is it just easier to have a single villain or hero to point a finger at? Does it make us feel like this chaotic, terrifyingly complex global financial system is actually being steered by a handful of people in a boardroom instead of a faceless, panicked herd of bond traders? I honestly don't know the answer, but the obsession is real, and it’s distracting you from the numbers that actually matter.

And that doesn't even get into the other stuff, like a lender's own costs or, you know, your own damn credit score, which has a bigger impact on your personal rate than anything Jerome Powell will ever say. We're all supposed to just nod along and pretend the system is simple, and honestly...

Then again, maybe I'm the crazy one here. Maybe it's comforting to believe someone's in charge.

It's All Just Noise

Look, the Federal Reserve's rate has an effect, sure. It influences short-term debt, HELOCs, the stuff banks use to shuffle money around overnight. But for your 30-year fixed mortgage, it's a whisper in a hurricane. The real drivers are inflation data, geopolitical chaos, and the cold, hard math of the bond market. Obsessing over the Fed's next move is a spectator sport. It's entertainment, not strategy. If you really want a better rate, stop watching C-SPAN and start shopping around with at least three different lenders. That will do more for your wallet than trying to read tea leaves from a central banker's speech. The rest is just noise designed to make you think the chaos is under control. It ain't.

Related Articles

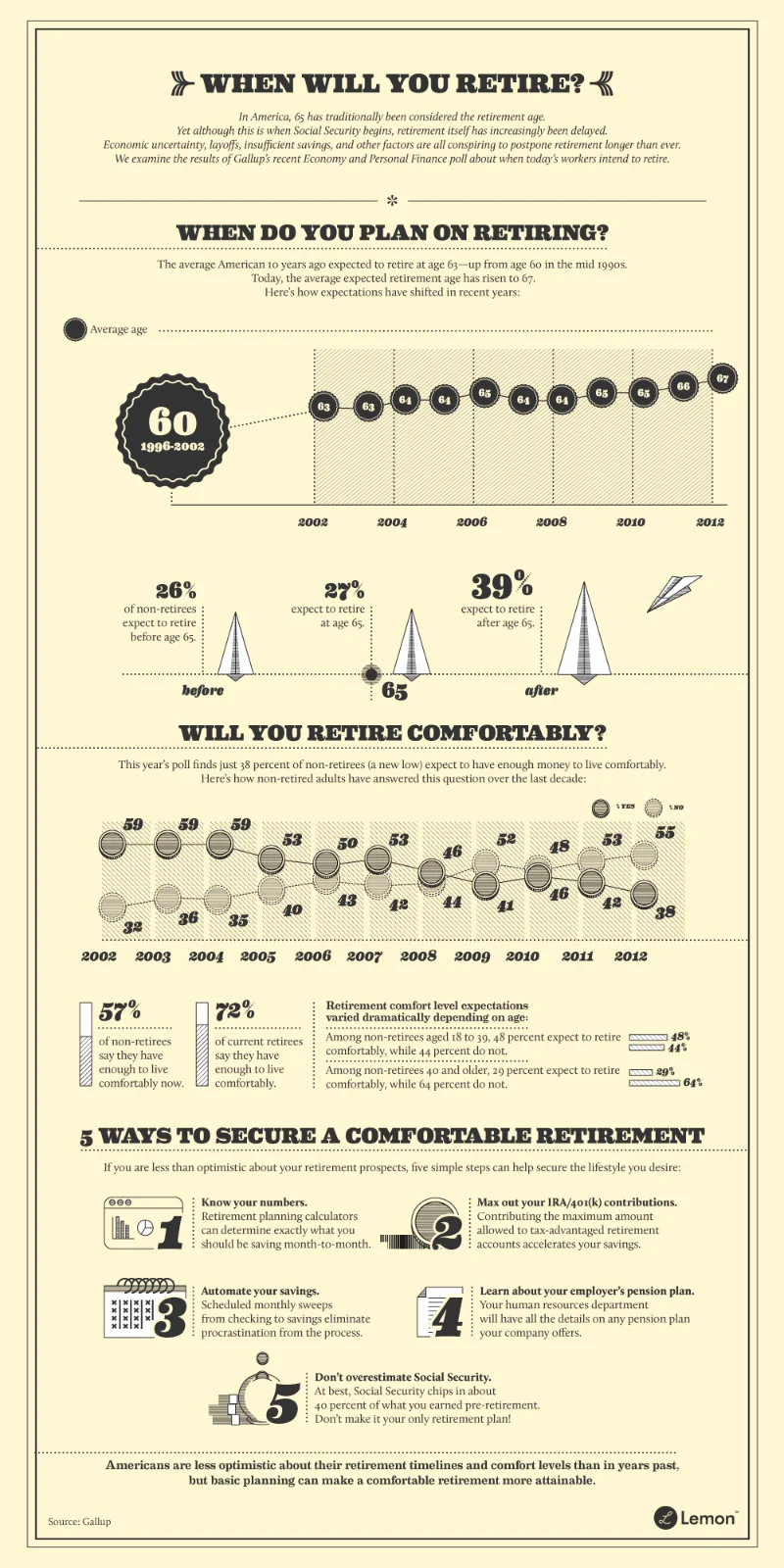

Retirement Age Realities: Social Security, Shifting Demographics, and Risky Moves

Generated Title: Social Security's "Perfect" Retirement Age of 63? The Data Just Doesn't Add Up The...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

Google Gets Buffett's Backing: What It Means and Why It Matters

Buffett's $5 Billion Google Gamble: Proof the AI Revolution is Just Getting Started Okay, folks, buc...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...

Dow Futures Tumble: Rate Cut Doubts and What We Know

AI Stock Jitters? Think Again—This Is Just the Beginning! Okay, folks, buckle up, because this week'...