Dow Futures Tumble: Rate Cut Doubts and What We Know

AI Stock Jitters? Think Again—This Is Just the Beginning!

Okay, folks, buckle up, because this week's market rollercoaster is not a reason to panic. In fact, it's a flashing neon sign pointing directly to the future. I'm seeing headlines screaming about tech sell-offs, Bitcoin wobbling, and general investor jitters. Yeah, the Dow slipped, the Nasdaq took a hit, and even Bitcoin took a nosedive. We saw American Bitcoin stock plummet before the bell despite reporting a rise in profit. Oracle, poor Oracle, got hammered worse than its Big Tech rivals. I get it, red numbers can be scary. But let's dig a little deeper, shall we?

The "Reckoning" Is Really a Launchpad

Daniel Skelly over at Morgan Stanley called this a potential "tech reckoning," and honestly, I kind of love that phrasing. But I see it not as a downfall, but as the market finally catching its breath before an even bigger leap. It's like when you're running a marathon – you don't sprint the whole way, right? You pace yourself, you adjust, and then you accelerate when the moment is right.

What we're seeing now is the market adjusting to the real potential of AI. The hype has been deafening, sure. But now, companies are putting their money where their mouth is. Oracle, for example, is betting big on AI, committing hundreds of billions to chips and data centers. Some investors are spooked by the sheer scale of it, but I'm telling you, this is the kind of bold move that defines the future. It’s like Ford deciding to mass produce the automobile – scary at the time, but ultimately world-changing.

And speaking of world-changing, let's talk about Bitcoin. Yes, it's down from its October peak. Yes, Bitcoin ETFs saw some big outflows. But zoom out for a second. We're talking about a technology that didn't even exist a couple of decades ago, and now it's a multi-trillion-dollar asset class! Volatility is part of the game, folks. And with investors betting on looser oversight under a new Trump administration, and Bitcoin trading at record levels, it's clear this isn't going away anytime soon.

Even Tesla, which had its worst day since July, is still being championed by Wedbush's Dan Ives, who sees a $600 price target. Ives believes the automaker's AI future is where investors should be looking. He gets it! It's not just about cars; it's about the AI that drives those cars, and everything else in our lives.

Consider Micron's jump of almost 7%! It shows that smart money is flowing into the companies building the infrastructure for this AI future. It’s a sign that the foundation is being laid for something huge.

It's not just about tech, either. Even news about CEO departures, like at Walmart, shouldn't be seen as a sign of trouble. John Furner, the incoming CEO, started as an hourly store associate! That’s the American dream in action, and it shows that Walmart is investing in its people and its future.

Now, I know what some of you are thinking: "But Aris, what about China's slowing economic momentum?" Okay, yes, retail sales and industrial production cooled off a bit in October. But China is still a massive economic force, and these are just minor speed bumps on the road to global growth.

This reminds me of the early days of the internet. Remember all the dot-com busts? People were saying the internet was a fad, a bubble that was about to burst. But guess what? The internet didn't go away. It evolved, it adapted, and it transformed the world. I believe AI is on a similar trajectory.

Let's not forget the human element here. All this technological progress comes with responsibility. We need to ensure that AI is used for good, that it benefits everyone, and that it doesn't exacerbate existing inequalities. It's a challenge, no doubt, but one we can overcome if we approach it with intention and empathy.

The Dawn of the AI Age is Upon Us

So, what's the real story here? It's not about a "tech reckoning" or a market correction. It's about the birth of a new era. We are on the cusp of an AI-powered revolution that will transform every aspect of our lives. And while there will be bumps along the road, the overall trajectory is clear: up, and to the right!

Related Articles

Robert Herjavec: Net Worth, Shark Tank, and Wife Kym – What We Know

Robert Herjavec's Million-Dollar Bet: Why Real Estate Still Holds the Keys to the Future Robert Herj...

Netflix Stock Split: What's the Real Impact?

Julian Vance: Netflix's Stock Split - A Clever Illusion? Netflix's recent 10-for-1 stock split has b...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

Scott Bessent vs. an 'Unhinged' Chinese Official: The Full Story and Why It's a Bigger Deal Than You Think

So, let me get this straight. The entire global economic system, the intricate web of supply chains...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

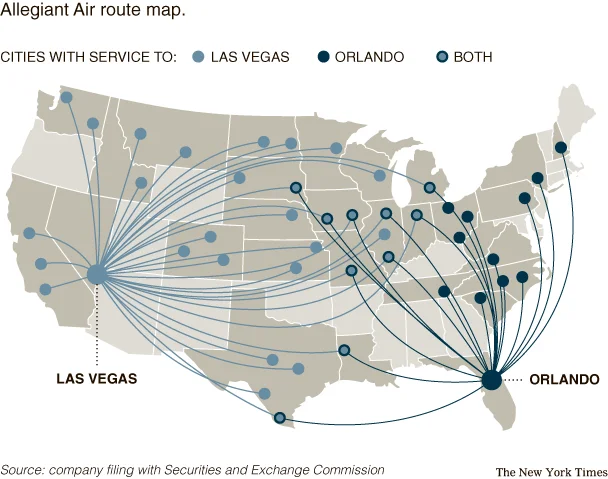

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...