Nvidia Stock Hammered: Price Volatility and Investor Flight

Generated Title: Nvidia's Dip and Meta's Ascent: Did the Smart Money Just Make a Smarter Move?

Cracks in the AI Armor?

The market's been buzzing about AI, and Nvidia (NVDA) has been the undisputed king of that hill. But a recent dip in Nvidia stock, coupled with Philippe Laffont's Coatue Management significantly increasing its stake in Meta Platforms (META), begs the question: is the smart money rotating out of the AI chip hype and into something more tangible?

Friday's market activity saw Nvidia shares down over 3%, while Tesla (TSLA) took a bigger hit, down about 4%. The broader tech selloff dragged down the Nasdaq by roughly 1.2%. Even AMD (AMD), another chip player, felt the pain, dropping more than 4%. The Dow Jones Industrial Average wasn't immune, falling over 530 points, or 1.1%. This market movement isn't just a blip; it's a potential indicator of shifting investor sentiment. Nvidia, Tesla stock hammered as tech selloff gets worse

Laffont's move is particularly interesting. He trimmed his Nvidia position, selling 1.6 million shares, while simultaneously adding 355,000 shares of Meta. Now, Meta comprises over 7% of his portfolio, making it his largest holding, according to the recent Form 13F filing. (These filings, while backward-looking, often offer clues to institutional thinking.) Nvidia, while still a significant holding at 4.5% of the portfolio, is now only his eighth-largest.

Beyond the Hype: Meta's AI Play

Nvidia's dominance in the data center GPU market is undeniable. They boast over 90% market share, and spending in that sector is projected to grow at 36% annually through 2033. CEO Jensen Huang touts their full-stack approach as a key advantage, claiming it leads to the lowest total cost of ownership. But, and this is a big "but," export restrictions have effectively locked Nvidia out of China, a massive AI market.

Trump initially agreed to let Nvidia sell scaled-back versions of its Hopper GPU in China, but Beijing reportedly warned companies against buying them after Commerce Secretary Howard Lutnick's… let's say colorful comments. More recently, Trump reversed course, blocking the export of scaled-back Blackwell GPUs. Nvidia previously commanded 95% market share in China; that number is now headed towards zero. Huang himself stated, "Currently, we are not planning to ship anything to China."

Meta, on the other hand, is quietly building a powerful AI infrastructure of its own. They're designing custom chips, developing the Llama large language models, and training machine learning models for ad targeting. These investments are already paying off, with increased user engagement and ad conversion rates. Revenue increased 26% to $51 billion, and GAAP net income (excluding a one-time tax charge) increased 20% to $7.25 per diluted share.

The market overreacted to Meta's plans to increase AI spending. Shares have fallen 23% from their August high. Wall Street expects Meta's earnings to increase at 16% annually over the next three years, a reasonable forecast given the projected 14% annual growth in adtech sales through 2030. At a valuation of 27 times earnings, Meta looks undervalued.

A Calculated Gamble or a Sign of Things to Come?

So, what's the real story here? Is Laffont simply rebalancing his portfolio, or does this signify a broader shift in investor sentiment away from pure-play AI chip manufacturers and toward companies that are effectively monetizing AI applications? It's tough to say for sure.

The market's volatility this week, fueled by anxieties over AI valuations and the Federal Reserve's potential pause on interest rate cuts, adds another layer of complexity. The end of the government shutdown, while seemingly positive, has also refocused investor attention on economic uncertainties. Forty-plus days without federal data releases leave the Fed with a partial view of the economic landscape. As BMO Private Wealth’s Carol Schleif noted, there will likely be "market chop over the coming weeks" as the data pipeline sputters back to life.

I've looked at hundreds of these filings, and Laffont's move is unusual. It's not just a minor adjustment; it's a significant reallocation of capital. While Nvidia still holds a prominent position in his portfolio, the increased emphasis on Meta suggests a belief in the long-term value of companies that can effectively integrate AI into their existing business models. Billionaire Philippe Laffont Sells Nvidia Stock and Buys a Mega-Cap AI Stock Down 23% From Its High

Maybe the Hype Got Ahead of Reality

Laffont's move isn't just a trade; it's a thesis. The market may have gotten ahead of itself on the AI chip hype, and the real winners will be those who can translate that technology into tangible profits. Meta, with its vast user base and established advertising infrastructure, is well-positioned to do just that.

Related Articles

Cook County Treasurer: Late Tax Bills and... Who's to Blame?

Generated Title: Cook County's "Helpful" Tax Notices: Or, How to Feel Like a Sucker Alright, Cook Co...

Ron Baron's Tesla Vision: Opportunity in the Tech Selloff

Ron Baron's Tesla Bet: More Than Just a Stock, It's a Revolution Ron Baron isn't just an investor; h...

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...

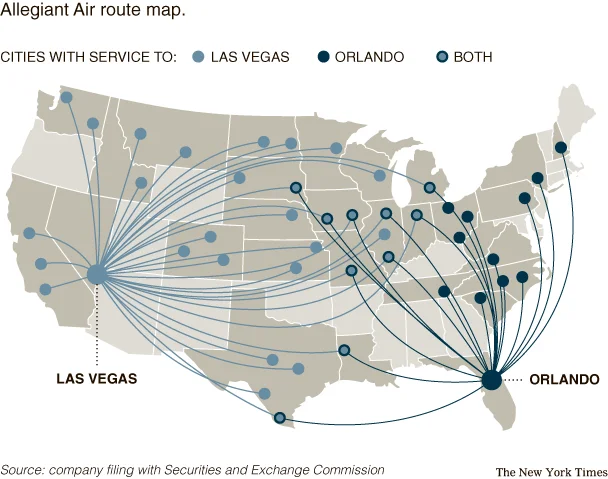

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

BABA Stock's AI Relaunch: Price Today and What It Means – What Reddit is Saying

Alibaba's AI Gambit: From E-Commerce Giant to AI-Powered Future? Okay, folks, buckle up. Because wha...