nvidia stock price: what's driving today's gains?

Generated Title: Nvidia's $265 Target: A Bull Run Built on Sand, or Solid AI?

Oppenheimer's Rick Schafer is bullish on Nvidia (NVDA), setting a price target of $265. That's a potential 39% climb, fueled by AI chip dominance. The question, as always, is whether the data backs up the hype. Schafer points to the GB300 Ultra, expecting it to drive sales and EPS above Street estimates for both the current and next quarters. He projects Data Center (DC) revenue, a hefty 88% of Nvidia's business, to jump 58% year-over-year. Oppenheimer Sets the Stage for Nvidia Stock Ahead of Earnings, Lifting the Price Target to $265

Cracks in the Foundation?

Let's drill down. A 58% jump is impressive, no doubt. But is it sustainable? Schafer mentions top cloud service providers installing roughly 1,000 racks per week. That’s a solid number, but what's the ramp-up time for these racks? Are they immediately generating revenue, or is there a lag? And what’s the average revenue per rack? These are the types of questions that need answering. We also need to consider the competitive landscape. AMD (Advanced Micro Devices) is not sitting still. Their MI300 series poses a direct challenge to Nvidia's dominance. While Nvidia currently holds the performance crown, AMD is aggressively pricing its offerings. This could squeeze margins, even if Nvidia maintains market share.

The networking side of the business, 16% of DC revenue, is also projected to grow significantly, up 63% in F3Q. Schafer attributes this to NVLink and Spectrum-X/Infiniband. He notes Spectrum-X already has a $10 billion run rate. But what’s the actual profit margin on these networking products? Is it comparable to the GPU business, or is Nvidia strategically accepting lower margins to secure market share in this crucial area? A parenthetical clarification: (Gross margins, of course, are not the only indicator of profitability, but they do provide a valuable snapshot).

The Tesla Mirage

Then there's the Tesla (TSLA) situation. The article mentions Tesla joining the trillion-dollar club, driven by its robotaxi business and the general tech run-up. Wedbush's Dan Ives projects Tesla launching robotaxis in 30 U.S. cities within a year, estimating a $1 trillion AI and autonomous opportunity. That's a bold claim. But robotaxis are facing regulatory hurdles and technological challenges. Geofenced launches with remote monitoring don't exactly scream "disruption."

This brings me to a broader point: the "AI arms race" narrative. Nvidia's CEO, Jensen Huang, expects global data center capital expenditures to reach $600 billion in 2025 and soar to $3-4 trillion by 2030. If Nvidia captures a third of that market, it could generate $1 trillion in revenue. But this projection relies on several assumptions: continued exponential growth in AI adoption, sustained capital expenditure by hyperscalers, and Nvidia maintaining its dominant market share. Any one of these assumptions could prove overly optimistic.

I've looked at hundreds of these projections, and this one feels particularly aggressive.

Nvidia's stock trades for less than 30 times next year's earnings, which is similar to Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL). But Nvidia's growth rate justifies a premium valuation, at least for now. The key is execution. Nvidia needs to continue delivering on its promises, expanding its product portfolio, and fending off competition from AMD and other players. The company is also facing a potential slowdown in the gaming sector, which accounts for 9% of its revenue. While Nvidia dominates the high-end segment, the overall PC market is facing headwinds. The partnership with Intel (INTC) to develop an x86 SoC integrated with GeForce RTX is a positive step, but it's unlikely to offset a broader decline in PC sales.

A Calculated Gamble

The Oppenheimer target of $265 for nvidia stock today hinges on a best-case scenario. While Nvidia is undoubtedly a leader in the AI space, the current valuation already prices in significant growth. The potential upside is there, but it comes with considerable risk. It's not a question of if Nvidia will continue to grow, but how much and at what cost. The projections for 2025, 2026, and 2027 have been raised to $4.56, $6.93, and $8.50, respectively, up from $4.55, $6.08, and $7.13. This represents increased confidence in Nvidia's earnings potential, but it also raises the stakes. The margin for error is shrinking.

Is This the Peak of the Hype Cycle?

Nvidia is a great company, but the current valuation is a reflection of the hype surrounding AI. Time will tell if the reality matches the expectation.

Related Articles

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...

BABA Stock's AI Relaunch: Price Today and What It Means – What Reddit is Saying

Alibaba's AI Gambit: From E-Commerce Giant to AI-Powered Future? Okay, folks, buckle up. Because wha...

RGTI Stock: A Comparative Analysis vs. IONQ and NVDA

The market action surrounding Rigetti Computing (RGTI) in 2025 presents a fascinating case study in...

MSTR & Bitcoin: What's Driving the Price Surge and Investor Excitement

Michael Saylor's Bitcoin Bet: Is MSTR About to Rewrite the Rules of Finance? Okay, folks, buckle up....

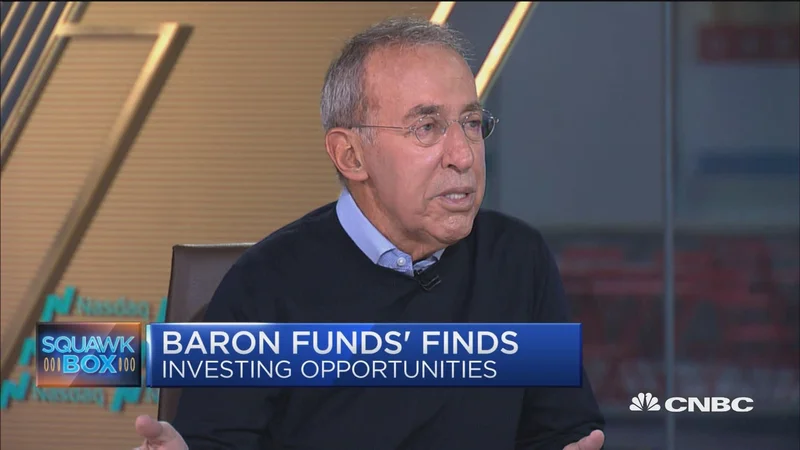

Ron Baron's Tesla Vision: Opportunity in the Tech Selloff

Ron Baron's Tesla Bet: More Than Just a Stock, It's a Revolution Ron Baron isn't just an investor; h...

mstr Stock: What's Driving the Price Surge and Bitcoin's Influence

Generated Title: MSTR's Dip? More Like a Launchpad for Bitcoin's Next Moonshot Okay, folks, let's ta...